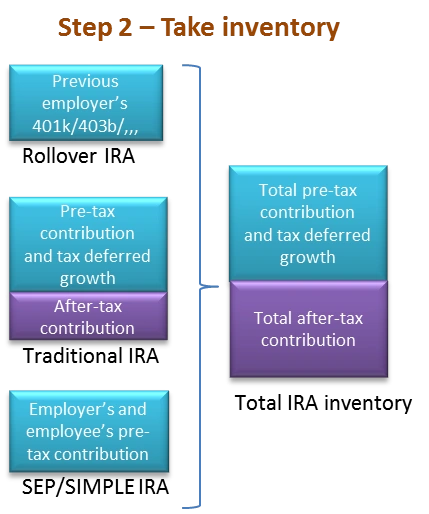

For instance if i roll my private ira into a company 401k today 1 11 2018 will i be able to star the back door roth strategy once that roll over is done guessing around 1 18 2018.

Back door roth ira rules 2018.

Or because i had a private ira for the calendar year of 2017 i am not eligible for a back door roth.

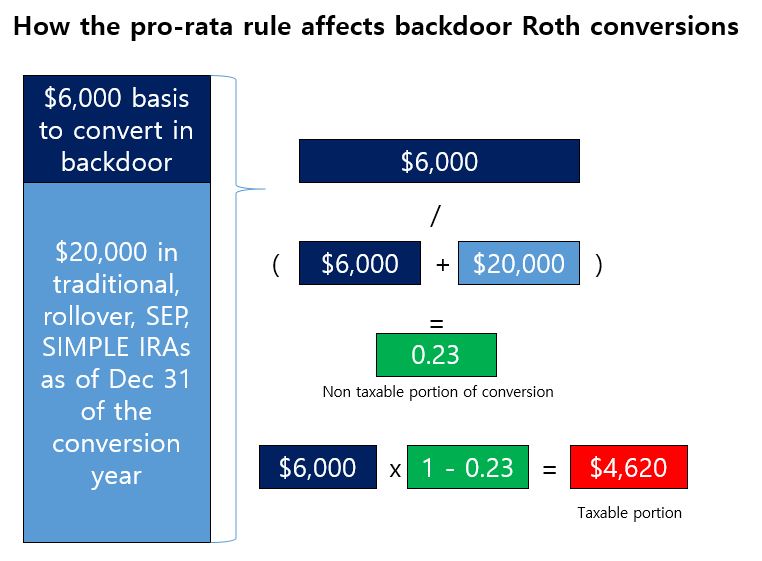

For 2018 the ability to contribute to a roth ira begins to phase out for singles with a modified adjusted gross income of 120 000 and it gradually fades out to where you can t contribute to a.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

For 2018 individuals cannot make a roth ira contribution if their income exceeds 199 000 married filing jointly or 135 000 single.

Investing rules of the backroads.

The backdoor roth ira.

In 2018 the ability to make contributions to a roth ira begins to phase out for.